Utah Tax Rate Percentage . The sales tax rate here is also near the u.s. utah income tax rate: Census bureau) number of cities that have local income taxes: your average tax rate is 10.94% and your marginal tax rate is 22%. The average effective property tax rate in utah is. utah has a flat 4.55 percent individual income tax rate. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. A listing of the utah individual income tax rates for various filing periods. The income tax rates and personal. Utah has a 4.55 percent corporate income tax rate. Utah state income tax tables in 2021. utah has a single tax rate for all income levels, as follows: This marginal tax rate means that your immediate additional. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. utah has a statewide flat income tax rate of 4.65%.

from utahchildren.org

Utah has a 4.55 percent corporate income tax rate. A listing of the utah individual income tax rates for various filing periods. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. Census bureau) number of cities that have local income taxes: utah has a statewide flat income tax rate of 4.65%. The average effective property tax rate in utah is. This marginal tax rate means that your immediate additional. Utah state income tax tables in 2021. utah has a single tax rate for all income levels, as follows:

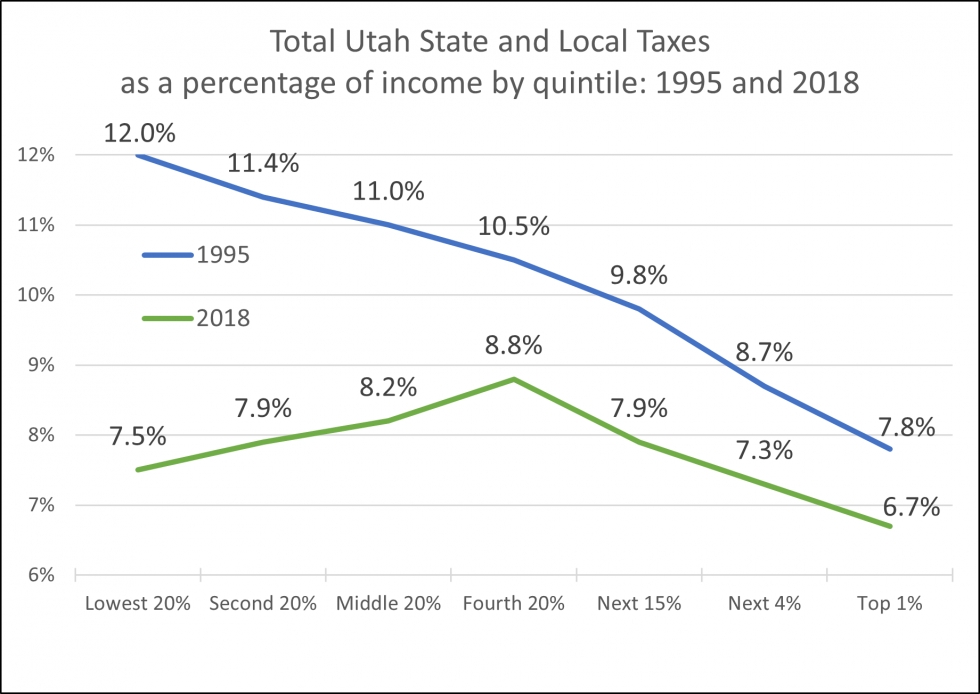

Voices for Utah Children Utah Tax Incidence History 1995 2018

Utah Tax Rate Percentage utah has a statewide flat income tax rate of 4.65%. utah has a single tax rate for all income levels, as follows: This marginal tax rate means that your immediate additional. your average tax rate is 10.94% and your marginal tax rate is 22%. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. utah income tax rate: A listing of the utah individual income tax rates for various filing periods. The sales tax rate here is also near the u.s. Census bureau) number of cities that have local income taxes: Utah has a 4.55 percent corporate income tax rate. utah has a flat 4.55 percent individual income tax rate. Utah state income tax tables in 2021. The income tax rates and personal. Utah also has a 6.10. The average effective property tax rate in utah is. utah has a statewide flat income tax rate of 4.65%.

From utahchildren.org

Voices for Utah Children Utah Tax Incidence History 1995 2018 Utah Tax Rate Percentage Census bureau) number of cities that have local income taxes: the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. Utah state income tax tables in 2021. The average effective property tax rate in utah is. Utah also has a 6.10. A listing of the utah individual income tax rates for. Utah Tax Rate Percentage.

From us.icalculator.info

Utah State Tax Tables 2023 US iCalculator™ Utah Tax Rate Percentage utah income tax rate: the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. A listing of the utah individual income tax rates for various filing periods. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. The income tax rates. Utah Tax Rate Percentage.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Utah Tax Rate Percentage The income tax rates and personal. Utah has a 4.55 percent corporate income tax rate. utah has a statewide flat income tax rate of 4.65%. This marginal tax rate means that your immediate additional. utah has a flat 4.55 percent individual income tax rate. Census bureau) number of cities that have local income taxes: A listing of the. Utah Tax Rate Percentage.

From www.youtube.com

NEW! Utah Tax Rates 1930 2022 YouTube Utah Tax Rate Percentage utah has a statewide flat income tax rate of 4.65%. Utah has a 4.55 percent corporate income tax rate. your average tax rate is 10.94% and your marginal tax rate is 22%. The sales tax rate here is also near the u.s. the tax tables below include the tax rates, thresholds and allowances included in the utah. Utah Tax Rate Percentage.

From incometax.utah.gov

Use Tax Utah Tax Rate Percentage Utah state income tax tables in 2021. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. A listing of the utah individual income tax rates for various filing periods. Utah has a 4.55 percent corporate income tax rate. utah has a flat 4.55 percent individual income tax rate. The. Utah Tax Rate Percentage.

From www.pinterest.com

Orem Utah tax rates as of 2016 Orem utah, Utah, Orem Utah Tax Rate Percentage utah income tax rate: Utah has a 4.55 percent corporate income tax rate. Utah also has a 6.10. your average tax rate is 10.94% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional. The sales tax rate here is also near the u.s. utah has a statewide flat income tax. Utah Tax Rate Percentage.

From www.ksl.com

Report Utah's tax burden at 20year low Utah Tax Rate Percentage Utah has a 4.55 percent corporate income tax rate. utah has a statewide flat income tax rate of 4.65%. The average effective property tax rate in utah is. A listing of the utah individual income tax rates for various filing periods. The income tax rates and personal. This marginal tax rate means that your immediate additional. utah income. Utah Tax Rate Percentage.

From utahtaxpayers.org

Utah’s Wireless Taxes Top Neighboring States and Rank 12th Highest in Utah Tax Rate Percentage Utah also has a 6.10. This marginal tax rate means that your immediate additional. utah has a single tax rate for all income levels, as follows: The sales tax rate here is also near the u.s. A listing of the utah individual income tax rates for various filing periods. your average tax rate is 10.94% and your marginal. Utah Tax Rate Percentage.

From gingerqdonelle.pages.dev

Utah State Tax Rate 2024 Vinni Jessalin Utah Tax Rate Percentage This marginal tax rate means that your immediate additional. Utah has a 4.55 percent corporate income tax rate. your average tax rate is 10.94% and your marginal tax rate is 22%. Census bureau) number of cities that have local income taxes: utah income tax rate: The average effective property tax rate in utah is. The income tax rates. Utah Tax Rate Percentage.

From utahtaxpayers.org

National Data on Property Taxes Shows How Valuable Utah’s Truthin Utah Tax Rate Percentage This marginal tax rate means that your immediate additional. The sales tax rate here is also near the u.s. The average effective property tax rate in utah is. your average tax rate is 10.94% and your marginal tax rate is 22%. utah income tax rate: the tax tables below include the tax rates, thresholds and allowances included. Utah Tax Rate Percentage.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Utah Tax Rate Percentage utah has a flat 4.55 percent individual income tax rate. A listing of the utah individual income tax rates for various filing periods. utah has a single tax rate for all income levels, as follows: the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. Utah state income tax. Utah Tax Rate Percentage.

From utahtaxpayers.org

One Third of Utah’s Expenditures Come from the Feds Utah Taxpayers Utah Tax Rate Percentage Census bureau) number of cities that have local income taxes: Utah has a 4.55 percent corporate income tax rate. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. The income tax rates and personal. This marginal tax rate means that your immediate additional. Utah also has a 6.10. utah. Utah Tax Rate Percentage.

From www.utahfoundation.org

Utah Priorities 2016, Issue 4 Taxes Utah Foundation Utah Tax Rate Percentage the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. utah income tax rate: The income tax rates and personal. The average effective property tax rate in utah is. Utah also has a 6.10. Utah has a 4.55 percent corporate income tax rate. The sales tax rate here is also. Utah Tax Rate Percentage.

From www.mortgagerater.com

Utah Tax Rate Insights for Residents Utah Tax Rate Percentage This marginal tax rate means that your immediate additional. The income tax rates and personal. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. The average effective property tax rate in utah is. Utah has a 4.55 percent corporate income tax rate. Utah also has a 6.10. A listing of. Utah Tax Rate Percentage.

From statetaxesnteomo.blogspot.com

State Taxes State Taxes Utah Utah Tax Rate Percentage utah has a flat 4.55 percent individual income tax rate. Utah has a 4.55 percent corporate income tax rate. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2023. utah income tax rate: The sales tax rate here is also near the u.s. The income tax rates and personal.. Utah Tax Rate Percentage.

From taxfoundation.org

Utah Sales Tax A Policymakers’ Guide to Modernizing Utah’s Sales Tax Utah Tax Rate Percentage Utah has a 4.55 percent corporate income tax rate. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. Census bureau) number of cities that have local income taxes: Utah state income tax tables in 2021. utah has a statewide flat income tax rate of 4.65%. The average effective property. Utah Tax Rate Percentage.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Utah Tax Rate Percentage utah has a flat 4.55 percent individual income tax rate. the tax tables below include the tax rates, thresholds and allowances included in the utah tax calculator 2022. The income tax rates and personal. Utah state income tax tables in 2021. Utah has a 4.55 percent corporate income tax rate. utah income tax rate: utah has. Utah Tax Rate Percentage.

From www.deseret.com

Utah one of flattest in federal taxes Deseret News Utah Tax Rate Percentage Utah has a 4.55 percent corporate income tax rate. Utah state income tax tables in 2021. A listing of the utah individual income tax rates for various filing periods. utah income tax rate: The average effective property tax rate in utah is. utah has a flat 4.55 percent individual income tax rate. the tax tables below include. Utah Tax Rate Percentage.